SpendSmart

UI / UX | User Research | User Testing | Prototyping | 2023 | 15 weeks

SpendSmart is the app for simple budgeting and managing your finances. It helps you track expenses, set budgets, and understand your spending habits. With a clean, user-friendly interface, SpendSmart makes it easy to stay on top of your money and reach your financial goals. Save time, reduce stress, and take control of your finances!

Project info

Product goal

To strengthen financial well-being by making it easier for users to track and manage their money. The goal is to help people take control of their finances and build better money habits.

Business goal

Businesses that offer services, such as subscriptions, can benefit from the app by simplifying payment processes, managing expenses, and helping customers stay within their budgets.

Process

The process started with research to define the problem, user goals, and challenges. User personas and scenarios were created, followed by testing and iterations to make the final design.

Solution

What if we created a convenient and easy to use system, that simplified the budgeting experience by only focusing on three main features: tracking expenses, setting budgets, and understanding spending habits.

Perfecting the budgeting and money management experience

Managing finances can be confusing and stressful, with unexpected costs and complicated budgeting. SpendSmart solves these problems by making the budgeting process simple and easy to use, saving you time and stress. My vision for the app was to create a simple, user-friendly design that makes managing money straightforward. Let's see what some young people think about their economy.

“It’s tough to get my finances under control and I wish saving money could be a simpler, more fun process. I just get tired of seeing all the numbers from my spending and bills, and I don’t even know where to start.”

03/06-23, Estelle Diego,

Student at Concordia University, US

image: Pexels

“I want managing my finances to be straightforward and efficient. Simplifying the saving process and focusing only on essential features would make a world of difference.”

03/18-23, Wilma Strom,

Finance Student, Biola University

image: Pexels

Process

Understand user’s needs through research.

Problem statement based on user insights.

The creation of visual designs, including tests improving the system.

04

RESULT

The final design of the project.

Research

Key Areas to understand

Why do young people want to save money?

Where does most of a young adult's money go?

What are some current tools young adults are using to manage their money?

What are the main problems young adults are facing today that prevent them from managing their money?

Defining the user

The target audience is financially conscious young adults (18-30 years) living in urban areas. They seek a user-friendly budgeting app that fits seamlessly into their busy lives and offers insightful financial guidance tailored to their goals. They are drawn to digital solutions and need educational resources to improve their financials and management skills.

Demographics

Alice

The Spontaneous

Image

Motivation

Preferences

Prefers user-friendly apps for easy money management and values automation for tracking expenses, paying bills, and saving without manual effort.

Goals

To have more freedom to explore new experiences, she wants to make the most of her money every month.

Frustrations

Too much time is spent on keeping track of money. Having a hard time staying on a budget.

Learnings based on research

Based on the research and discovers, these points were kept in mind when moving on to designing the product.

Study conducted: Spring 2023, 38 participants

Interviewees spend the most money on entertainment, food, rent, and travel. They do not have a specific way of keeping track of expenses.

Interviewees want a clear and fun tool where you can see a balance of spent/left to spend, focus on saving, and where you enter fixed sums.

To make it easy to understand your finances, you should have your budget and balance right on the home page.

Users want to focus on saving. Therefore, this aspect needs to be present during the creation of the budget. Also, users want to enter fixed sums and not percentages.

The main categories the users want to see in the budget are food, rent, entertainment, and travel.

Want to see a balance between what they have spent, and what they have left to spend. They also want to see overviews from previous transactions.

The problem

As a user, I want to stay on the same platform when tracking my expenses and planning my budgets, without needing to use multiple tools.

As a user, I often lack the time or motivation to organize my finances, making it hard to stick to a budget.

As a user, I want detailed insights into my spending habits, such as where my money is going and how I can save more effectively, to make informed financial decisions.

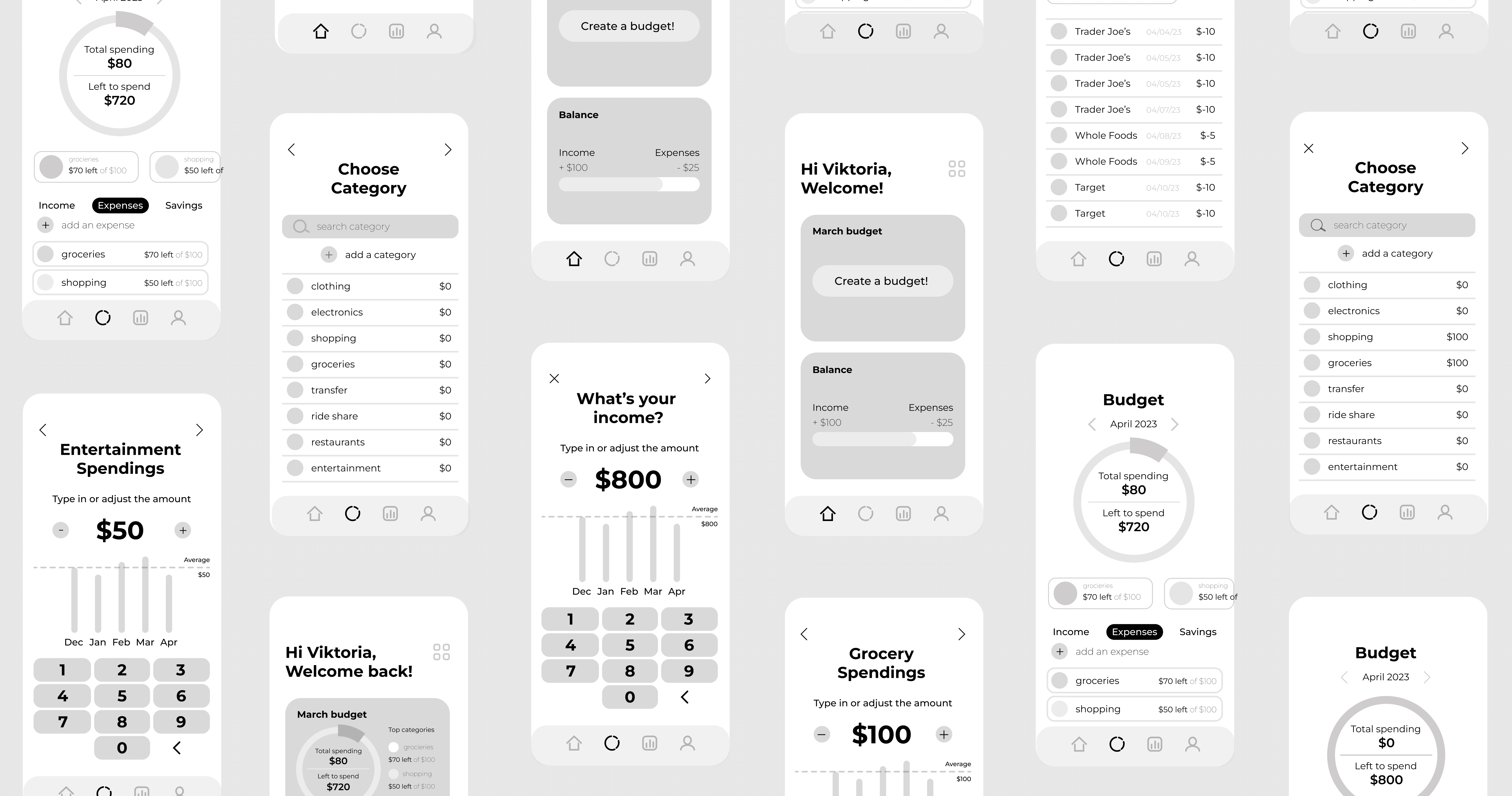

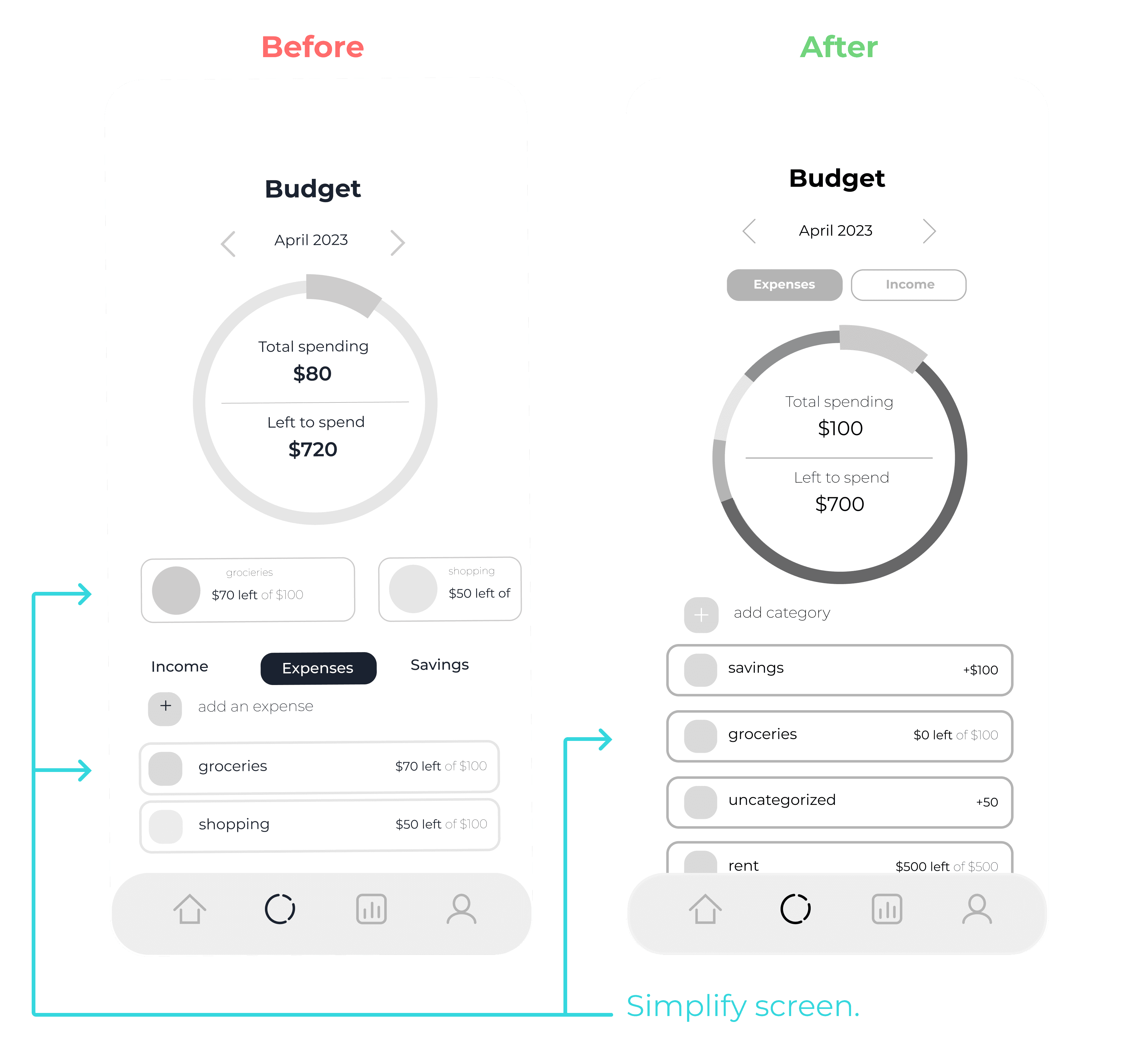

Wireframes and components

With all the research and info I gathered, it was time to ideate. I began designing the app's crucial parts, like the main budgeting info balance.

Low fidelity wireframes

Medium fidelity wireframes

Component library

With all the research and info I gathered, it was time to ideate. I began designing the app's crucial parts, like the main budgeting info balance.

Logo

The logo represents what my brand is all about - simplicity and balance.

Typography

The typography represents what my brand is all about - simplicity and easy to understand.

Montserrat Bold

Montserrat Medium

Montserrat Regular

Montserrat Light

Aa Bb Cc Dd Ee Ff Gg Hh Ii Jj Kk Ll Mm Nn Oo Pp Qq Rr Ss Tt Uu Vv Ww Xx Yy Zz

1234567890-=!@#$%^&*()_+

Logo

The colors represents what my brand is all about - simplicity and ease.

Icons

The icons represents what my brand is all about - simplicity and easy to understand.

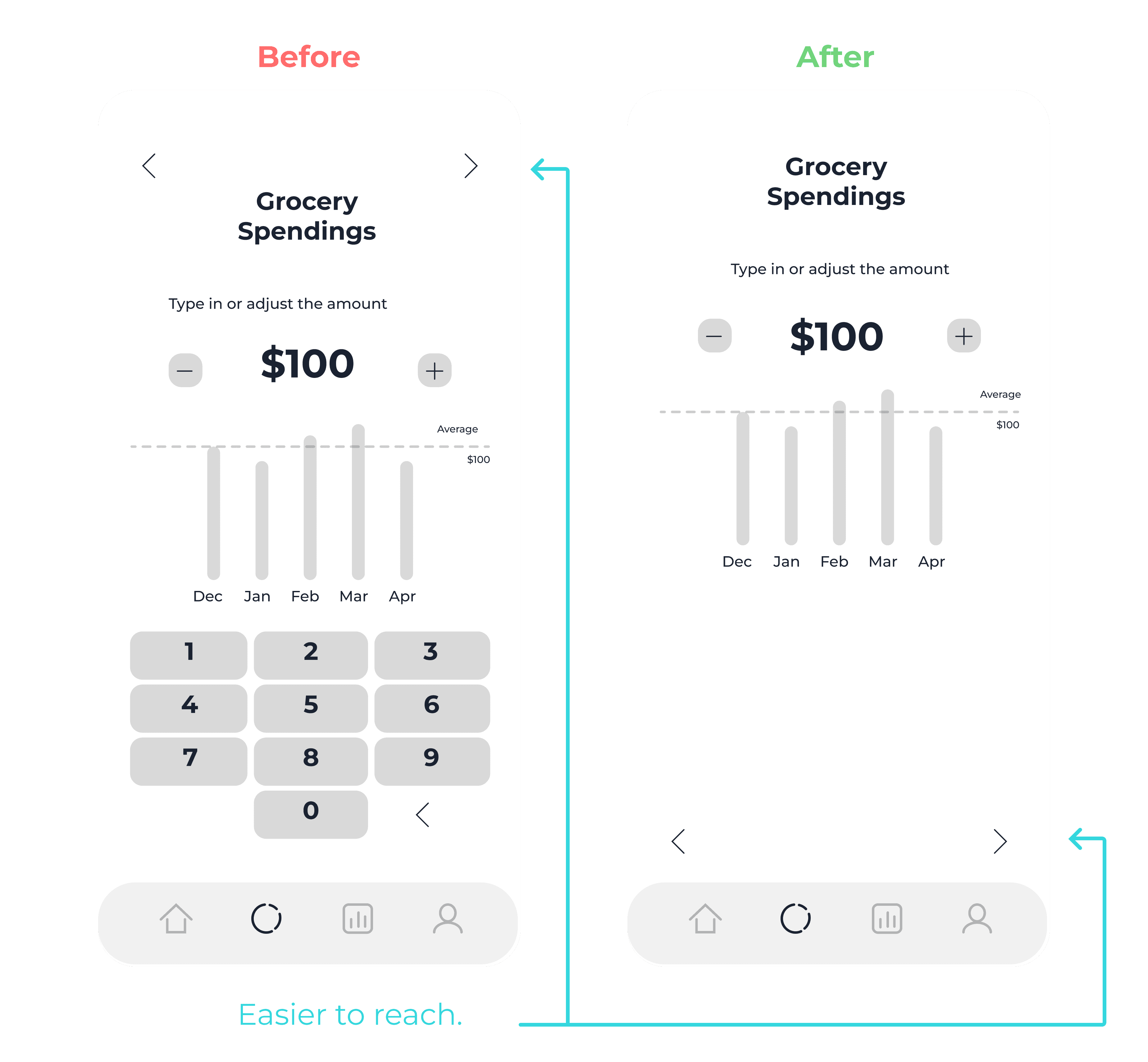

“Important UI should be more easily accessible because that helps me save time.”

03/16-23, Johanna Leth,

Biochemistry student, University of Lund

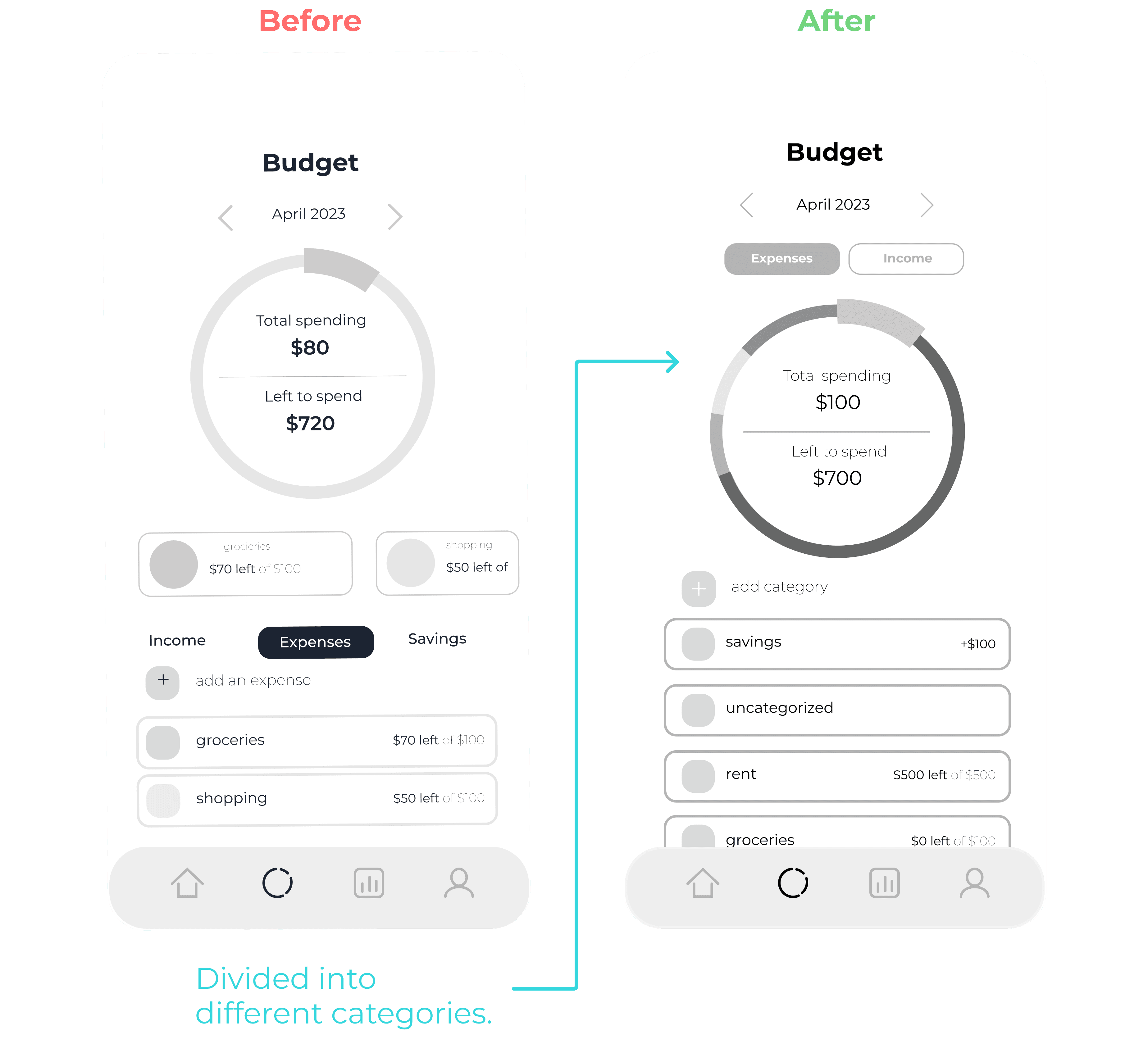

“I want to get an overview of how much I spend in each category so that I can better understand my spending habits.”

03/16-23, Vera Larsson,

dentist student, University of Umeå

“I don’t understand where to look - there are too many options which makes me even more tired than I was before opening the app.”

03/16-23, Maria Lind,

Interaction and Design student, University of Lund

Final design

Takeaways

When I created SpendSmart, I knew that simplicity was key. A straightforward design ensures users can navigate the app effortlessly. Clear visuals are crucial too, as they save time by presenting financial information in an easily digestible format. By simplifying complex numbers, SpendSmart transforms budgeting into an enjoyable and convenient experience. It's not just about managing money; it's about empowering individuals to take control of their financial futures and follow their dreams with confidence.